Intelligent due diligence automation for modern fund managers.

Problem Statement

Our client, a France-based investment management firm, faced significant challenges in conducting third-party due diligence across their growing network of service providers, including custodians, administrators, and IT vendors. Their existing process was heavily manual, relying on spreadsheets, inconsistent formats, and disjointed email communication. This led to duplicated efforts across teams, delayed decision-making, and difficulty in tracking compliance progress. Moreover, the lack of centralized oversight and automation increased the risk of errors and made it nearly impossible to maintain a scalable and audit-ready workflow. These inefficiencies contributed to rising operational risk, reduced transparency, and growing regulatory pressure.

Our Solution

AdroitMinds architected and delivered a highly scalable and reliable, cloud-based platform tailored to meet the client’s evolving business needs. The solution leveraged a modular micro services architecture to ensure flexibility, resilience, and future-proof scalability.

To ensure smooth adoption and operational efficiency, we focused on user-centric design by building a platform that is both easily customisable and intuitive.

What made the platform different?

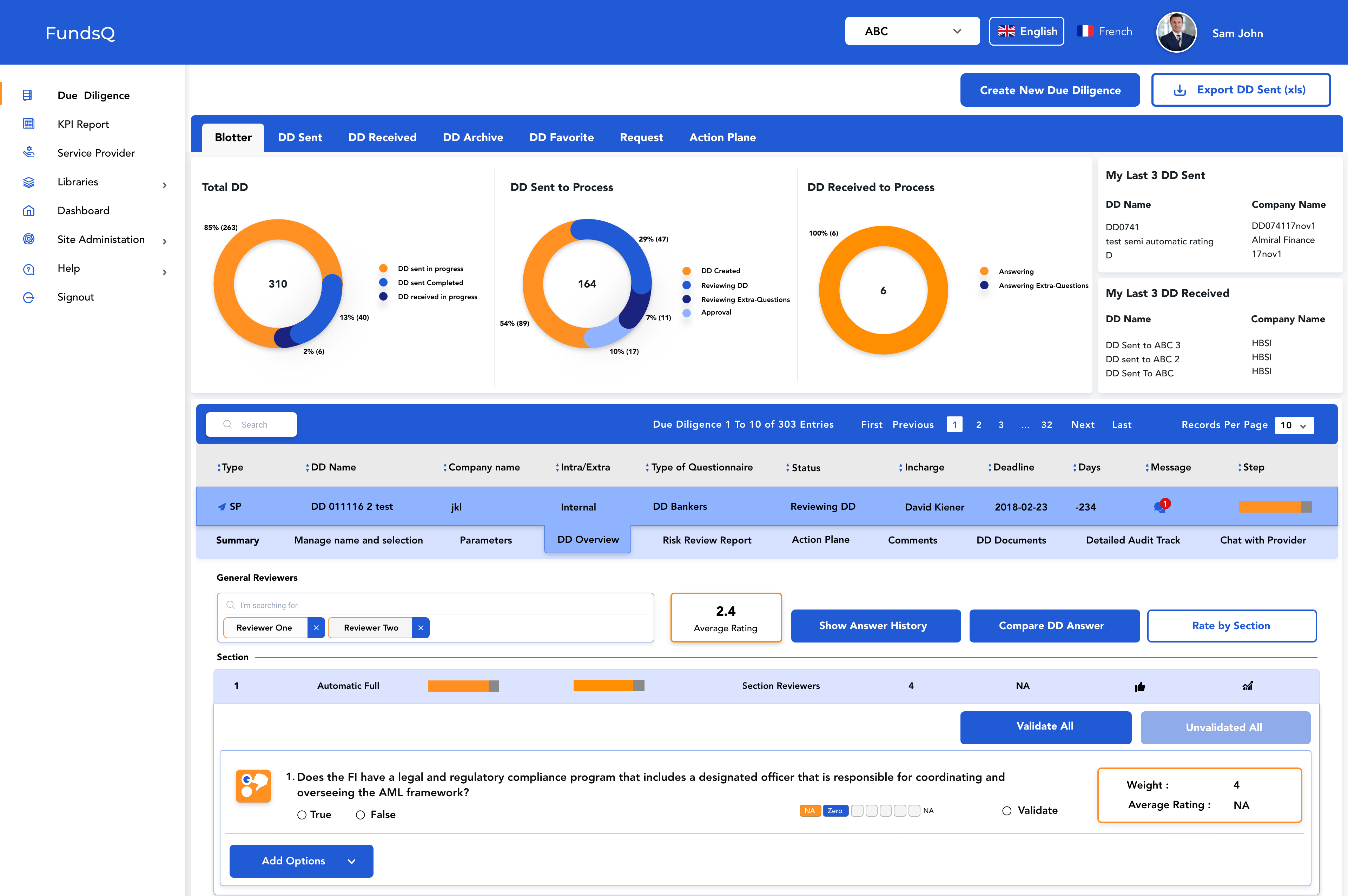

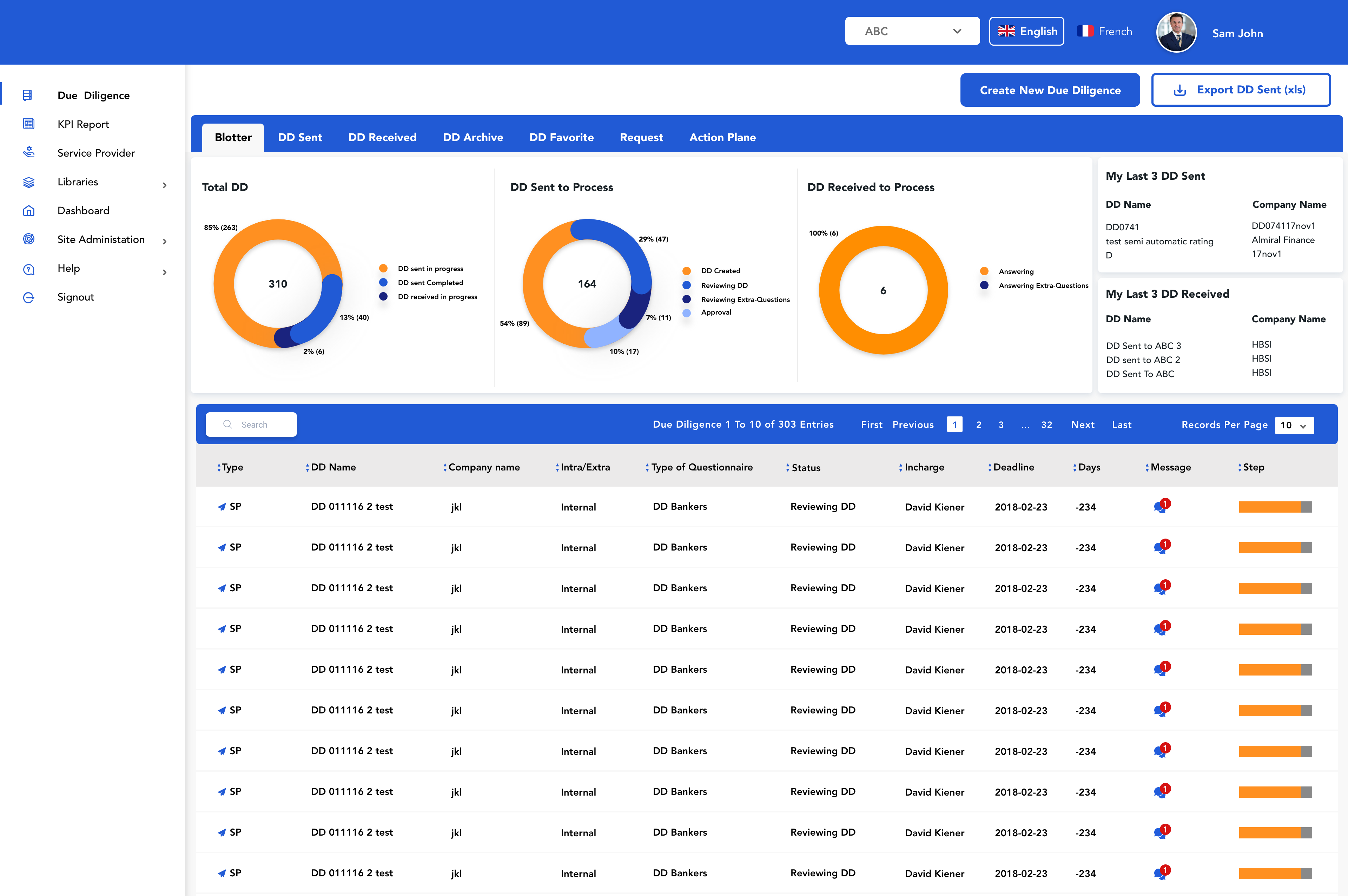

- Continuous Due Diligence: Platform supports both new and ongoing due diligence processes, enabling organizations to not only assess third parties at onboarding but also continuously monitor compliance and risk over time. This ensures that the latest data and insights are always available, helping teams proactively identify and address potential issues before they escalate.

- Customizable Questionnaires: Utilize a library of expert-prepared questions aligned with current regulations, or create tailored questionnaires to suit specific needs.

- Efficient Information Collection: Invite third parties to complete questionnaires through the platform, with features like reminders and the ability to assign questions to specific users, enhancing response rates and accuracy.

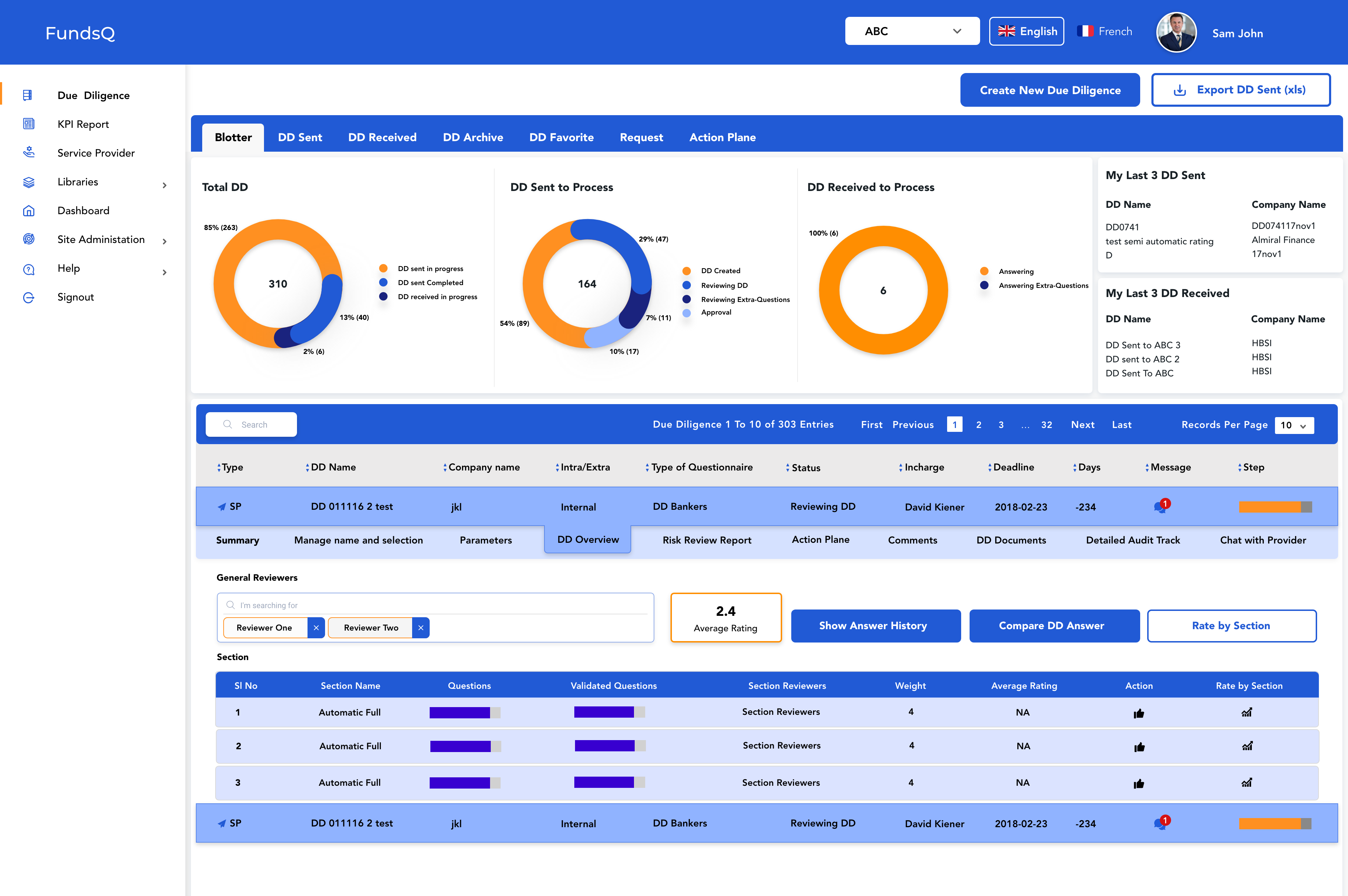

- Review and Scoring: Analyse responses with tools for commenting, scoring (including automated options), and requesting clarifications, facilitating a thorough assessment of third-party risks.

- Activity Tracking: Maintain a comprehensive audit trail of all actions and communications, ensuring transparency and accountability throughout the due diligence process.

- Live Dashboards: Access real-time insights into due diligence statuses, risk scores, and other key metrics to inform decision-making and demonstrate compliance.

- GDPR & Data Compliance: Platform is engineered with compliance at its core, delivering powerful capabilities to maintain detailed audit trails, enforce data retention policies, and streamline data access requests—ensuring your firm meets GDPR and other regulatory obligations with ease and confidence.

By digitizing and automating due diligence workflows, platform enables financial institutions to enhance efficiency, ensure compliance, and make informed decisions regarding their third-party relationships.

Tools & Technologies

- Figma

- React JS

- jQuery

- .Net Core and .Net framework

- ASP.Net MVC

- SQL Server

- Automated Document Processing

- Intelligent Questions

- Bootstrap

- ChartJS

- GoogleCharts

- Google reCAPTCHA

- JQuery

- iTextSharp

- Microsoft SSO Integration

- SendGrid

- Twilio

- Firebase

- Azure Blob Storage

- SharePoint

- Azure WebJobs

- Figma

- React JS

- jQuery

- .Net Core and .Net framework

- ASP.Net MVC

- SQL Server

- Automated Document Processing

- Intelligent Questions

- Bootstrap

- ChartJS

- GoogleCharts

- Google reCAPTCHA

- JQuery

- iTextSharp

- Microsoft SSO Integration

- SendGrid

- Twilio

- Firebase

- Azure Blob Storage

- SharePoint

- Azure WebJobs

Outcome and Business Impact

- Replaced an expensive third-party platform with an AI enabled scalable, reliable, cloud-based platform tailored to meet the client’s evolving business needs.

- AI enabled Audio transcription and keyword detection workflow reduced compliance review time by over 60%.

- Blob Storage and SharePoint combination enables efficient, secure, and scalable audio file handling.

- Excel uploads enabled faster operations with reduced dependency on backend teams.

- Integrated notification system improved communication across multiple channels.

- Positioned the client to extend the platform modularly for future needs.